SHS Chairman- Vinh, Do Quang & “SHS-The flagship of a financial investment group” strategy

SHS Chairman- Vinh, Do Quang & “SHS-The flagship of a financial investment group” strategy

At the beginning of the year, which also marks the approaching period of the shareholder meetings, businesses are highly focused on building business plans to formulate appropriate strategies and goals. Mr. Vinh, Do Quang - Saigon - Hanoi Securities JSC’s Chairman (stock code: SHS - HNX) - shared his thoughts with some journalists about the plan of his company that is both a securities company and a public listed organization.

Q: How do you evaluate the stock market in 2023, its prospects for 2024, and could you please share some highlights of SHS achievements in the past year?

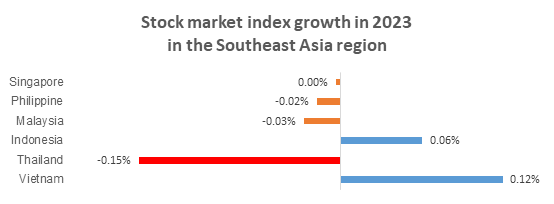

A: The Vietnamese stock market in 2023, in my opinion, was quite positive. After a significant decline in 2022, all key indicators showed growth, with the VN-Index rising by 12.2%, a relatively high figure compared to other markets in Southeast Asia. This is also significant considering the backdrop of global uncertainties, Vietnam's economic growth slowdown, and strong net selling of foreign capital.

In 2023, SHS recorded positive business results with pre-tax profit of 684 billion VND, a 247% increase compared to 2022, placing it among the top 10 securities companies with the highest profits in the market. We also officially launched the provision of derivative securities services, thereby providing SHS customers with additional risk management tools to deal with market volatility in the underlying market.

In 2024, Vietnam continues to face challenges from external factors as the global economy is anticipated to experience a "soft landing", with growth rates declining while political conflicts in some regions persist, increasing the risk of economic fragmentation.

Nevertheless, in my view, the economic outlook for Vietnam in 2024 is still assessed positively, with a higher growth rate compared to 2023, thanks to momentum from FDI inflows, loosened fiscal policies, easing pressure on interest rates, and reduced external exchange rate pressures. These are crucial factors that provide a stable foundation for the stock market, thereby fostering development in the coming years. Furthermore, with the Fed's gradual interest rate reduction expected in the latter half of 2024, global interest rates are forecasted to cool down, creating conditions for foreign capital inflows to return to emerging and frontier markets, including Vietnam.

Q: Recently, you have registered to purchase SHS stocks. Could you please share anybreakthrough strategy for SHS long-term development?

A: In the long term, specifically from now until 2030, SHS Board of Directors aims to position SHS as the flagship and promptly develop a leading financial investment group in Vietnam, with SHS as the core center. The financial group will include SHS and entirely new subsidiary companies in the financial market. With the support of these specialized subsidiary companies, SHS will have more momentum to excel in the securities sector. In the next 1 to 2 years, SHS will have specific plans to present to the Shareholders' General Meeting.

With a charter capital of 8.131 trillion VND, assets of 11.457 trillion VND, and a profit of 684 billion VND in 2023, SHS excels as one of the listed securities companies with effective capital utilization in the market. We will continue to enhance financial capacity, accompanied by safety measures to further maximize capital efficiency. We will leverage this strength in efficient capital utilization to provide customers with comprehensive investment advisory products and help them optimize asset management.

With this strategic plan, I, myself, as an investor, have also registered to invest an additional 5 million SHS shares to increase my ownership percentage. After the successful transaction, my ownership ratio will be 1.54% of SHS charter capital. Although this ratio may not be large, it reflects my confidence in SHS future development path, committing to accompany and strive for the highest benefit for shareholders.

We believe that with a passionate, dedicated, innovative, and experienced team of employees, along with a clear development strategy and financial advantage, SHS will continue to achieve success in the future, affirming its unique position.

Q: In your capacity as SHS Chairman, could you please elaborate on SHS plans for 2024?

A: In the context previously mentioned and based on leveraging the achievements obtained over the past 15 years, SHS in 2024 will implement solutions to strengthen internal capabilities, enhance competitiveness, and assert its position. Our operational motto is customer-centricity, dynamism, innovation to improve the quality of products and services, best serve and meet all customer needs, with customer satisfaction and benefits serving as motivation for all business activities of the Company.

Firstly, we will innovate the organizational structure, upgrade business processes towards a more professional, systematic, and transparent organization to focus on fast, efficient, and market-responsive service. We may consider establishing a management system, from the Board of Directors, Supervisory Board, or Executive Board with the participation of foreign resources, attracting personnel who are industry-leading experts to deliver the best products and services to customers.

SHS plans to expand office space, create a dynamic, modern, and convenient working environment, harnessing the creativity of employees. Although SHS current remuneration system is relatively high in the labor market, SHS will continue to focus on improving talent attraction policies, commensurate with its stature and new development phase.

Secondly, in the era of strong digital transformation in all sectors, especially in the financial and securities industry, SHS will continue to invest in technology infrastructure and online services to optimize trading experiences for customers.

At the same time, SHS will focus on improving information technology systems promptly in accordance with the direction of state management agencies to upgrade, meet the requirements of trading capacity, clearing and settlement, lending, etc., of FTSE Russell and MSCI.

Thirdly, we will implement product and service structuring, diversifying to meet all customer needs at competitive costs, ensuring SHS always innovates, leading in the development trends of financial and securities products and services. For the IB sector, SHS will prioritize cooperation to enhance capital arranging capabilities for large organizations and enterprises in key sectors of the economy, not only providing Investment Banking services such as underwriting, equity advisory, divestment, equity offering, stock listing, etc., but also committing to financial advisory, investment advisory, and effective capital mobilization strategy consultancy for customers.

SHS will leverage its diverse, reputable ecosystem and relationships to become a trusted partner of large organizations and enterprises, accompanying customers in the development and expansion of business activities.

SHS will provide comprehensive financial solutions tailored to the needs and conditions of each customer, ensuring transparency, safety, and high efficiency. Advising to enhance the quality of goods in the listed market and affirming the trust foundation for investors in enterprises is also a contribution to promoting the market upgrading process.

Q: Could you please share some of SHS activities in line with the Government's orientation for the stock market recently?

A: As far as I know, recently, the Government has issued directives on the Development Strategy for the Stock Market until 2030 in Decision No. 1726/QD-TTg dated December 29th, 2023. To align with this strategy, SHS will enhance investment activities and issuance of Green Bonds, Social Bonds, and Sustainable Bonds...

SHS commits to supporting enterprises in raising capital for projects that have positive impacts on the environment and society, promoting innovative finance to support Sustainable Development Goals, creating added value for shareholders and the investment community.

Particularly, in addition to complying with all domestic legal regulations, SHS will strengthen cooperation with international financial organizations, adhere to the best standards, regulations, and enforcement measures of the international stock market, ensuring high transparency.

This will elevate SHS credibility level, creating more favorable conditions for regional and international negotiation and trade activities. SHS will seize cooperation opportunities, transactions, and attract FDI capital, stimulating demand and facilitating indirect investment capital inflows into the domestic stock market.

Regarding the Retail Brokerage segment, besides the existing products serving customers and still highly valued by customers, we will provide a system of products for the high-end customer segment, accompanied by added values, alongside a focus on optimizing financial investment efficiency. We are determined to regain our position in the Top 10 brokerage market shares on both the HSX and HNX exchanges.

(Translated by Saigon – Hanoi Securities JSC (SHS) IR Department - BOD's office| investor@shs.com.vn)

Các bài viết liên quan

- Chủ tịch HĐQT Đỗ Quang Vinh lên chiến lược lấy SHS làm lá cờ đầu của Tập đoàn tài chính đầu tư - 12/03/2024

- SHS: Thông báo Giảm 1% lãi suất cho vay giao dịch ký quỹ và ứng trước tiền bán từ ngày 22/03/2024 - 20/03/2024

- Mr. Thanh, Nguyen Chi - SHS CEO&Legal Representative – officially since March 25, 2024 - 24/03/2024

- SHS BOD’s Resolution on the 2024 Annual General Meeting of SHS Shareholders - 10/03/2024

- SHS CHÚC MỪNG NHÂN DỊP NGÀY QUỐC TẾ PHỤ NỮ 8/3 - 07/03/2024

- Announcement of SHS Chairman registering to buy SHS shares - 21/02/2024

VN

VN